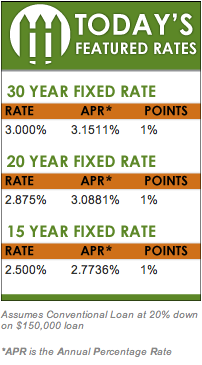

After last week's drop, our current rates have remained unchanged since last Monday. So be sure to take advantage of them before they begin to creep up.

After last week's drop, our current rates have remained unchanged since last Monday. So be sure to take advantage of them before they begin to creep up.

If you are thinking about or preparing for a home buy or a refinance, you should definitely be thinking about locking in your rates. Even though rates are not expected to rise drastically anytime soon, it is still smart to lock in the rate before the rate increases even a decimal point. This article from Fox Business provides quick directions on how to lock in a rate, what your options are and what extra costs may be associated with a lock in. So after you are comfortable with where the rates are, make sure you lock it in with your mortgage lender before it potentially rises.

Bank of Little Rock Mortgage is also rolling out a new blog to provide our experience and expertise on mortgage finance, written in plain English for you to follow easily. We call itThe Mortgage Statement.

Are you interested in seeing if you prequalify for a home loan? We have a quick-and-easy online prequalification process you can access below.

If you have any questions, comments or concerns, we would love to hear from you. Just contact us and let us know what you need. For more information on Arkansas mortgage rates, check out our website.

Happy Monday,

Scott McElmurry

President & CEO of Bank of Little Rock Mortgage

NOTE: Your mortgage rate can be affected by a number of factors, including your credit score, loan-to-value ratio, your down payment and the loan program you choose. No matter what, we'll always find you the best mortgage loan at the best rate, guaranteed. For more information, visit our Today's Rates page.