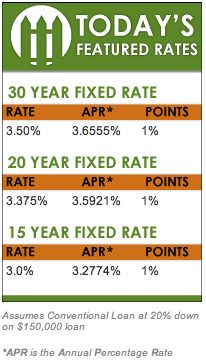

Mortgage rates have not changed since last week, continuing to stay steady through the month of February.

In a recent study released by Freddie Mac, 27 percent of borrowers refinanced during 2012's fourth quarter to a shortened payment term and 95 percent switched to a fixed-rate loan. With rates more likely to rise rather than fall, it is wise to choose a fixed-rate loan over an adjustable-rate loan. For more information, read the entire study on Yahoo! Finance. And if you are considering a refinance before rates climb higher, be sure to consider a fixed-rate at a shorter term.

Bank of Little Rock Mortgage is also rolling out a new blog to provide our experience and expertise on mortgage finance, written in plain English for you to follow easily. We call it The Mortgage Statement.

Are you interested in seeing if you prequalify for a home loan? We have a quick-and-easy way for you to get prequalified for a mortgage online.

If you have any questions, comments or concerns, we would love to hear from you. Just contact us and let us know what you need.

Happy Monday,

Scott McElmurry

President & CEO of Bank of Little Rock Mortgage

NOTE: Your mortgage rate can be affected by a number of factors, including your credit score, loan-to-value ratio, your down payment and the loan program you choose. No matter what, we'll always find you the best mortgage loan at the best rate, guaranteed. For more information, visit our Today's Rates page.